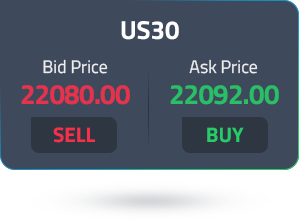

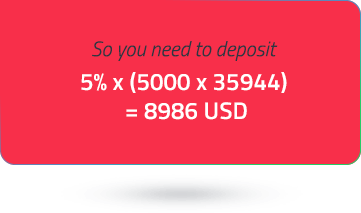

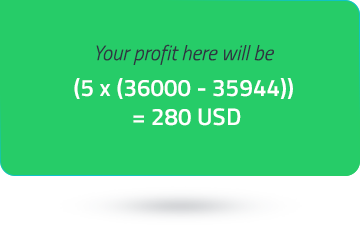

Nexus Capital Solution provides exposure to the major global stock indices through index Contracts for Difference (CFDs), at competitive leverage on world-class trading platforms. Online CFD indices trading is a great way to participate in the top global stock markets. With Nexus Capital Solution, you can trade CFD indices from across the world at margins starting at just 5%. Trade AUS200 cash indices at AU$1 per point. Stay on top of overseas stock index movements with access to NASDAQ 100, S&P 500, EUREX, indices and more.

We’ve partnered with leading banking and non-banking financial institutions to ensure a deep liquidity pool, so that you get the best available market prices and ultra-low latency order execution.