What is

CFD Trading

and How Does it Work?

CFDs or (Contract for Difference or Contracts for Difference) are a popular form of derivative instruments. Derivatives are financial instruments that allow you to trade an asset in the global markets without actually owning it. Common examples of derivative instruments are options, futures or swaps.

With CFDs you don’t have ownership of the actual assets. Rather, you exchange the price difference of the underlying asset, from the time that the contract was opened to when it is closed. This closing date or contract expiry date is not fixed, making CFDs different from other forms of derivatives, like futures. Your contract can be for the short term or continue for the long term.

One advantage of trading CFDs is that you can speculate on price movements in any direction, up or down. The gain or loss that you make will depend on whether your forecast pans out. With CFDs, you can trade a large variety of assets, including currencies, equities, indices, cryptocurrencies (including bitcoin) and commodities.

It is necessary to understand how this instrument works before trying your hand at it.

How Does Trading CFDs Work?

To understand the whole process, you need to first know the concept of margin trading. Leveraged CFDs allow you to gain wide exposure to price movements, without needing to invest the total trade value. This means that leverage allows you to gain wider exposure to the market than what you could have done with the capital in your trading account.

Trade CFDs – What is CFD Margin?

When you start trading CFDs, you will need to open a “margin account,” preferably with a regulated broker. The broker will allow you to trade larger positions, by offering leverage. This means that you get the opportunity to magnify your earnings, with a small capital investment from your end. However, remember that leverage can also magnify losses. So, choose your leverage wisely.

To maintain your margin account, a fixed minimum amount of capital has to be present in the account at all times, to serve as a cushion against potential losses. This is known as the “initial margin” or “deposit margin.” It is the difference between the funds you borrow from your broker and the full trade value of your position.

In case you incur losses, and the capital in your account is depleted below the required level, the broker will issue a “margin call.” This means that you will need to deposit the required amount in your account, known as the “maintenance margin.”

Suppose the shares of XYZ Company are trading at $130 per share. You decide to buy 10,000 units of a contract at this price. Now, if you had to pay the total value of this contract, it would cost you:

$130 x 10,000 = $130,000.

By using leverage, you can gain exposure to the same number of shares, but with a lower capital investment. If the required margin is 5% of the total trade value, you will be required to pay only $6.50 per CFD unit, in your trading account as margin.

So, your total margin requirement will be

(0.05 x 130,000) = $6,500.

This is significantly less than $130,000 but you get the same level of exposure, as if you had bought the shares directly. Plus, you are entitled to 100% of the gains. On the other hand, you will also bear 100% of any losses.

Suppose the shares of XYZ Company are trading at $130 per share. You decide to buy 10,000 units of a contract at this price. Now, if you had to pay the total value of this contract, it would cost you:

$130 x 10,000 = $130,000.

By using leverage, you can gain exposure to the same number of shares, but with a lower capital investment. If the required margin is 5% of the total trade value, you will be required to pay only $6.50 per CFD unit, in your trading account as margin.

So, your total margin requirement will be

(0.05 x 130,000) = $6,500.

This is significantly less than $130,000 but you get the same level of exposure, as if you had bought the shares directly. Plus, you are entitled to 100% of the gains. On the other hand, you will also bear 100% of any losses.

This margin percentage will depend on the country from where your trade. Different regulatory bodies have different limits for leverage. These limits have been put in place to protect traders against significant losses during time of heightened volatility.

Going “Long” or “Short”

in CFD Trading

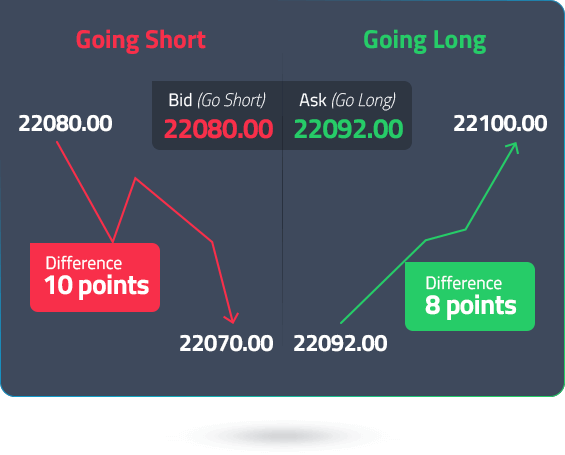

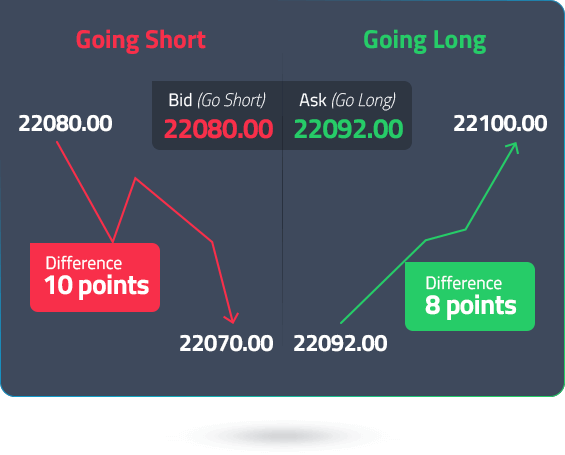

When you trade CFDs, you can speculate on whether the market prices will move up or down. If you believe that the prices will rise in the future, you buy the underlying asset or “go long.” But, if you think that prices will decline in future, you sell the asset, or “go short.” You still get to exchange the difference between prices at open and close, but you get a chance to benefit from declining prices as well

An Example of

Leveraged CFD Trading

Suppose you want to trade CFDs, where the underlying asset is the US30, known as the ‘’Dow Jones Industrial Average Index. ” Let us suppose that the US30 is trading at:

Bid/Ask Spread

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

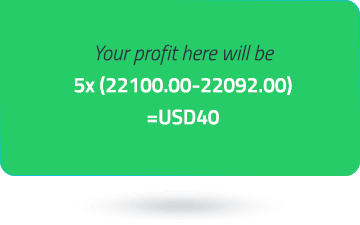

Now, getting back to the trade, you decide to buy 5 contracts of US30 because you think that the US30 price will rise in the future. Your margin rate is 1% . This means that you need to deposit 1% of the total position value into your margin account.

In the next hour, if the price moves to 22100.00/22112.00, you have a winning trade. You could close your position by selling at the current (bid) price of US30 which is 22100.00

In this case, the price moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In the loss scenario where your free equity, (account balance+ Profit/Loss) falls below the margin requirements (1105), the broker will issue a margin call. If you fail to deposit the money, and the market moves further against you, when your free equity reaches the 50% of your initial margin the contract will be closed at the current market price, known as the “stop out.”

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point.” For Indices, 1 pip is equal to a price increment of 1.0 which is also called an Index point. In the forex market, like in the above example, it is used to denote the smallest price increment in the price of a currency. For assets like the AUD/USD, which include the US Dollar, a pip is represented up to the 4th decimal place. But, in case of pairs that include the Japanese Yen, like the AUD/JPY, the quote is usually up to 3 decimal places.

This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In case your initial margin is lower, the broker will issue a margin call. If you fail to deposit the money, the contract will be closed at the current market price. This process is known as “marking to market.”

How to Hedge Using CFDs?

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

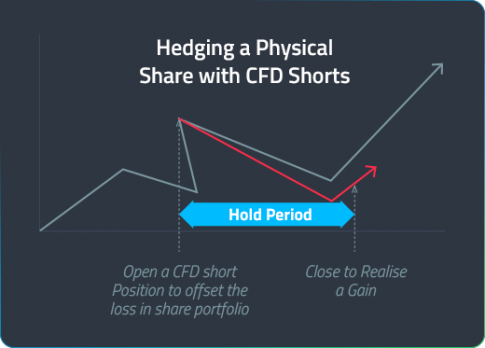

A significant advantage of CFD trading is the opportunities to hedge your portfolio against short-term market volatility, within an existing position. Hedging is a strategy you can use when you want to invest to protect against downside risks. You can also limit your gains to do this.

So, let’s say you have an equity portfolio worth AUD 150,000, consisting of prominent shares on the ASX 200 index. These are split up in 10 tranches of AUD 15,000 each. You could own AUD 15,000 worth of Adelaide Brighton shares and AUD 15,000 worth of ANZ Banking Group Ltd.

Now, if you believe that both these companies might suffer a short-term dip in share price, due to a bad earnings report, you could offset some of the potential loss by going short on them through a CFD.

Instead of selling these shares in the open market, you assume two CFD short positions in Adelaide Brighton and ANZ Banking Group Ltd. About 10% of the market exposure, which is AUD 3,000, could be required to set up this hedge.

But, why choose a CFD short rather than simply selling the shares and buying them again later, after the price drops? The reason to choose the CFD route could be:

You will attract capital gains when you sell your shares, which is taxable. This will be unnecessary, unless you want to get rid of these assets once and for all. In CFDs, you won’t need to pay stamp duty and trading costs will be limited to margin and spread.

If the market does go downwards, the losses in your equity portfolio will be offset by your short CFD positions.

Hold Period

Now, after the market closes each day, any CFD position open in your account could incur holding costs. This depends on the applicable holding rate, as well as the direction of your position; based on which the cost can be negative or positive. The holding cost is one of the costs of trading CFDs.

How Do You Start Trading CFDs?

Step 1 |

Build Your Knowledge

Considering that you are reading this article, you are already on Step 1. Learn all you can about CFDs and how to trade them. Know how they differ from other forms of trading.

Step 2 |

Open a Margin Account with a CFD Broker

Register and open a CFD account with a regulated CFD broker, so that your funds are protected and you gain access to robust risk management and trading tools. You will need to deposit your initial margin in your trading account before you can start trading. Check margin requirements and choose the leverage ratio based on your risk profile. Leverage can erode your entire capital, if the market moves in the wrong direction. Start by practising what you learn on a demo account.

When you choose to trade with a regulated broker, you get:

Client fund segregation

ECN pricing

Robust trading platforms

Deep liquidity

Ultra-low spreads

Wide range of financial instruments

Educational resources

News and economic calendar

Secure trading and fund transfer

Step 3 | Create a Trading Strategy

First choose the asset you want to trade. CFDs can offer you exposure to numerous asset classes, all from a single trading platform. It all depends on your trading capital, time commitment, risk-reward ratio, market knowledge, goals and preferred strategies. Having a proper trading plan and sticking to it is essential for maintaining discipline and implementing good real-time risk management strategies.

Step 4 |

Gain Familiarity with Technical and Fundamental Analysis

When you want to find trading opportunities, there are two approaches to analysing the market, fundamental analysis and technical analysis. In the former, by keeping track of geo-political events, economic data releases and breaking news events, you can stay tuned to events that might move the global financial markets. Learn how these events can lead to price fluctuations and volatile markets.

Next is technical analysis. Through the use of technical indicators, you can make informed decisions about potential price trends and patterns in the future. On robust CFD trading platforms like MT4, there are pre-installed indicators and charting tools that can help you analyse the market comprehensively.

Step 5 | Choose Your Trading Platform

Choose a platform that gives you flexibility and stability in trading. State-of-the-art technologies like MT4 provide a wide range of tools to track price fluctuations, market news, manage risk and get alerts anywhere and anytime. Test your system on a demo account to see if it suits your requirements and trading style.

Step 6 |

Always Use Stop Loss

Risk management is essential for every trade, no matter the market conditions or the position size. To restrict potential losses, here are some tools you can use:

Stop Loss Order: A smart placement of a stop loss order will allow the system to automatically close your position when the market reaches a certain price level. This can minimise losses when the market moves in an unfavourable direction.

Take Profit: This order closes out your position once you have gained a specific level of profit. This protects your positions from unnecessary market risk.

Trailing Stops: This moves your stop-loss further, if the market goes in your favour, but as soon as the market reverses, it closes the position. This order prevents your positions from getting closed too early.

Advantages of CFD Trading

So, provided that you are in the hands of a regulated broker, you invest in education and have a robust trading system, CFD trading can actually provide you a lot of opportunities for long term success.